First Actuarial can help trustees meet their compliance duties in a cost-effective way.

We can take care of regulatory compliance, helping trustees manage their numerous governance challenges and make informed decisions quickly.

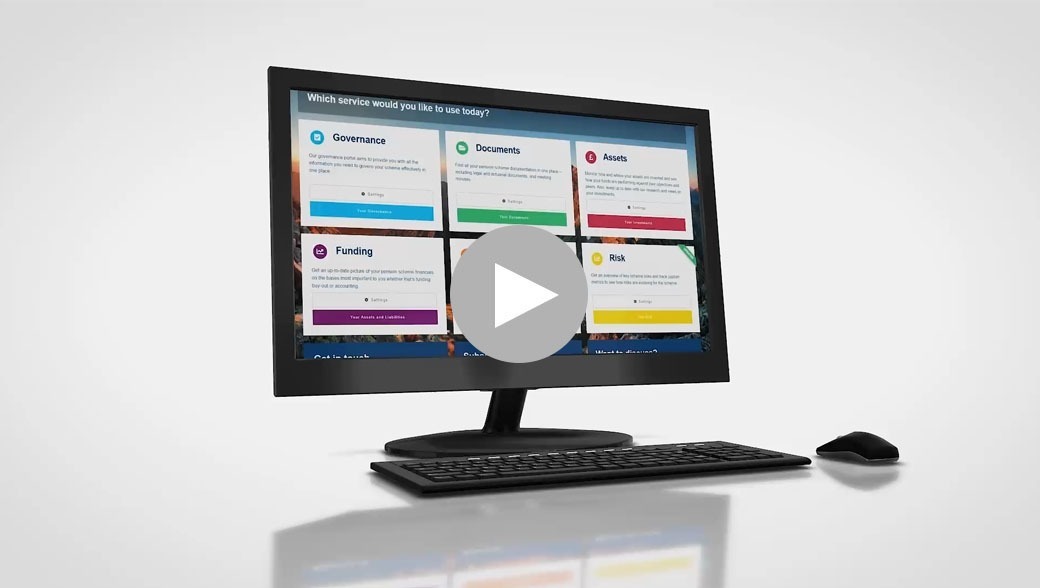

We also give clients access to our online Client Hub. This provides all the tools and information trustees need to comply with the general code.

Trustees using the Client Hub can:

- Store all scheme governance material together in a secure, online portal

- Carry out a gap analysis to identify additional measures required

- Keep track of which policies and processes help them meet specific requirements of the code

- Set due dates for reviewing policies and processes at the required frequency

- Use a simple risk assessment and recording tool and export the results for their ORA.

Our experienced consultants and scheme secretaries can also prepare a draft ORA, which the trustees’ risk management function can review and approve.

And on an ongoing basis, we’ll keep track of regulatory duties and issues that trustees may miss, especially if their day-to-day work lies outside pensions.