We prepare a review, in which we put forward a potentially suitable long-term funding target along with a supporting rationale, meeting the expectations of The Pensions Regulator. The review incorporates our understanding of the scheme, its trustees and the sponsoring employer. We liaise with the Scheme Actuary as needed.

Our long-term funding target review includes a detailed report of advice and recommendations, providing:

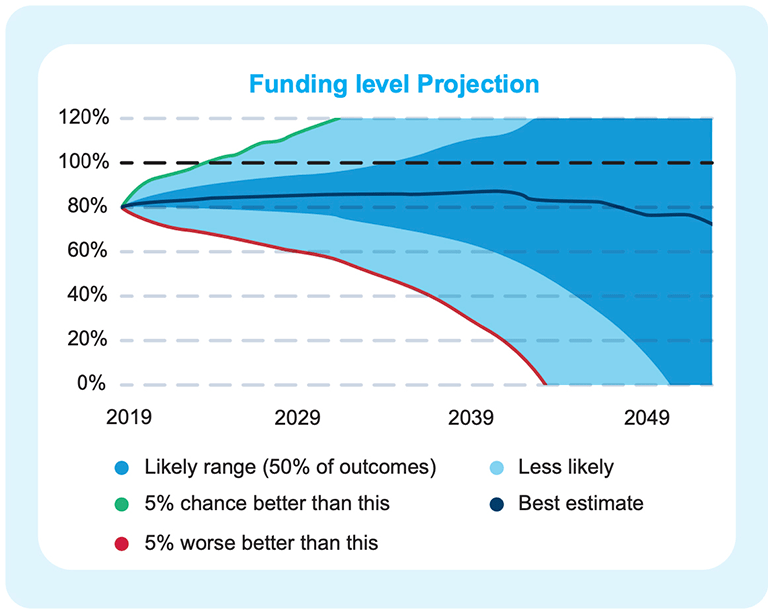

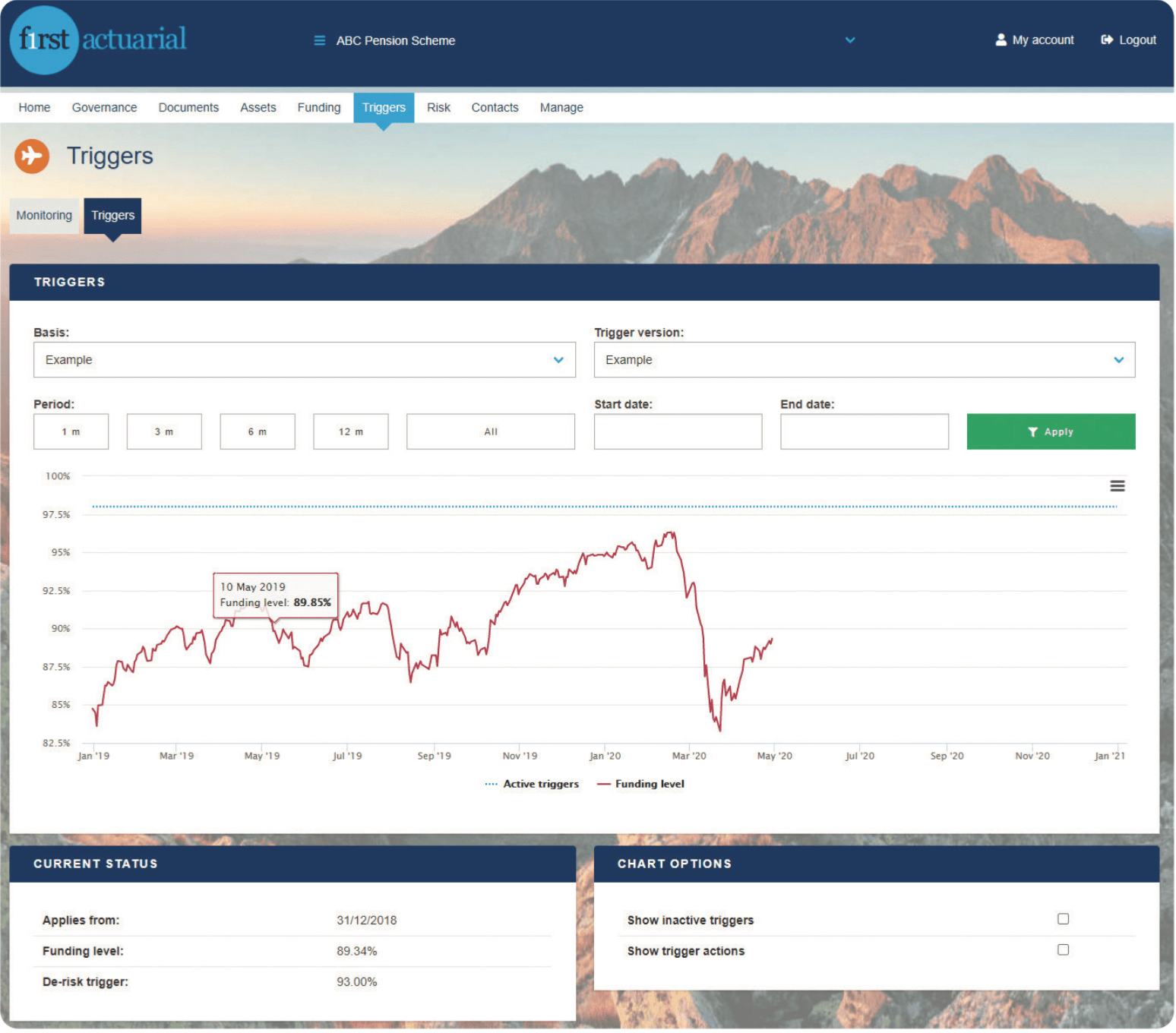

- Short-term and long-term risks

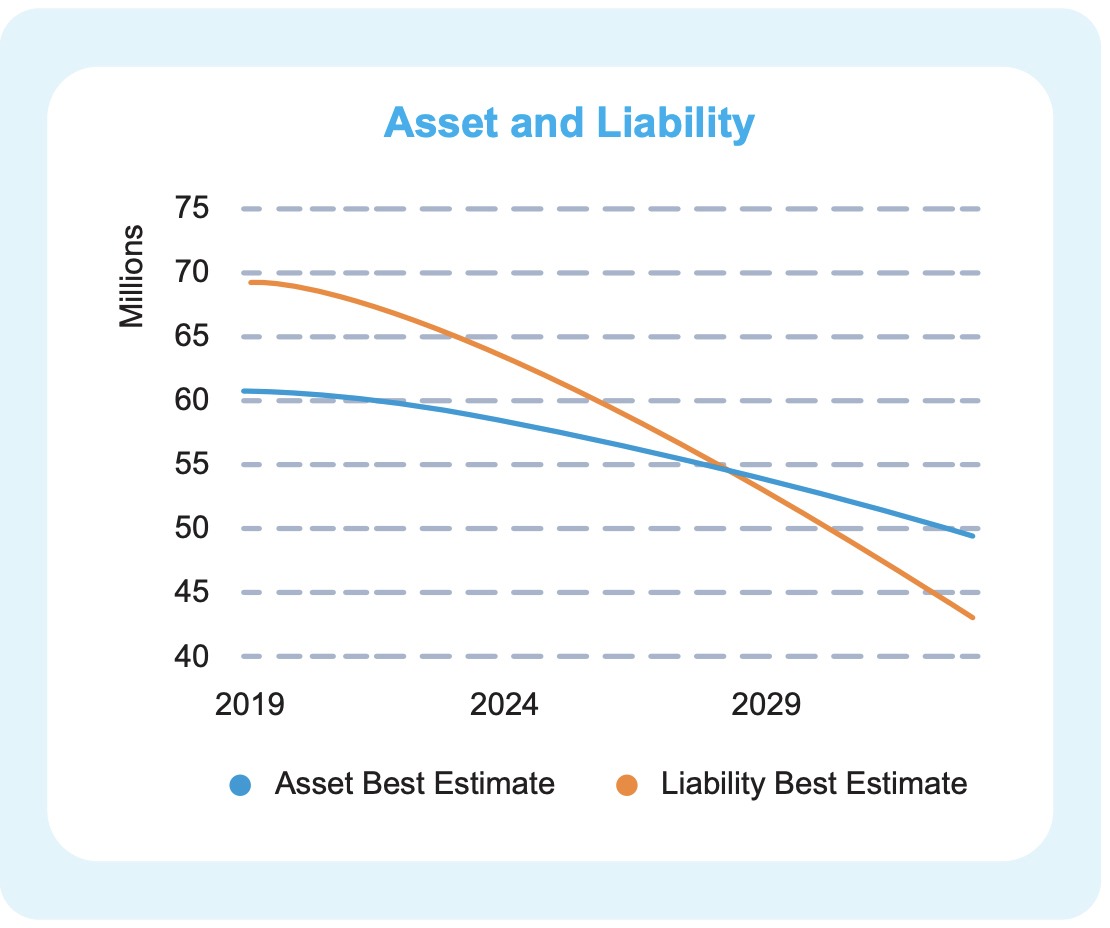

- Financial modelling, which allows us to demonstrate the impact of different approaches on the funding position, and how it develops over time

- Projections of likely scheme size at the point where the long-term funding target is likely to be reached

- A suitable investment strategy for the point at which full funding is achieved

- Cashflow information to support the modelled projections

- Suitable timeframes for long-term funding targets, in line with regulatory expectations, allowing for the scheme’s maturity and investment approach, as well as any contributions received.